Your basic journal retains a cautious document of each transaction, nevertheless it doesn’t create your monetary statements directly. Journal entries permit for the verification of economic information, offering transparency and accountability. They also assist in the detection and correction of accounting errors, as inconsistencies may be traced again to their authentic entry. The common journal is an integral part, making certain the integrity and reliability of an organization’s monetary reporting.

A ledger is an account of ultimate entry, a master account that summarizes the transactions within the Firm. It has individual accounts that report assets, liabilities, fairness, income, bills, gains, and losses. Debits and credits characterize the elemental mechanics of this method what is a general journal, indicating increases or decreases in specific account types. Debits increase asset and expense accounts, while lowering liability, fairness, and income accounts.

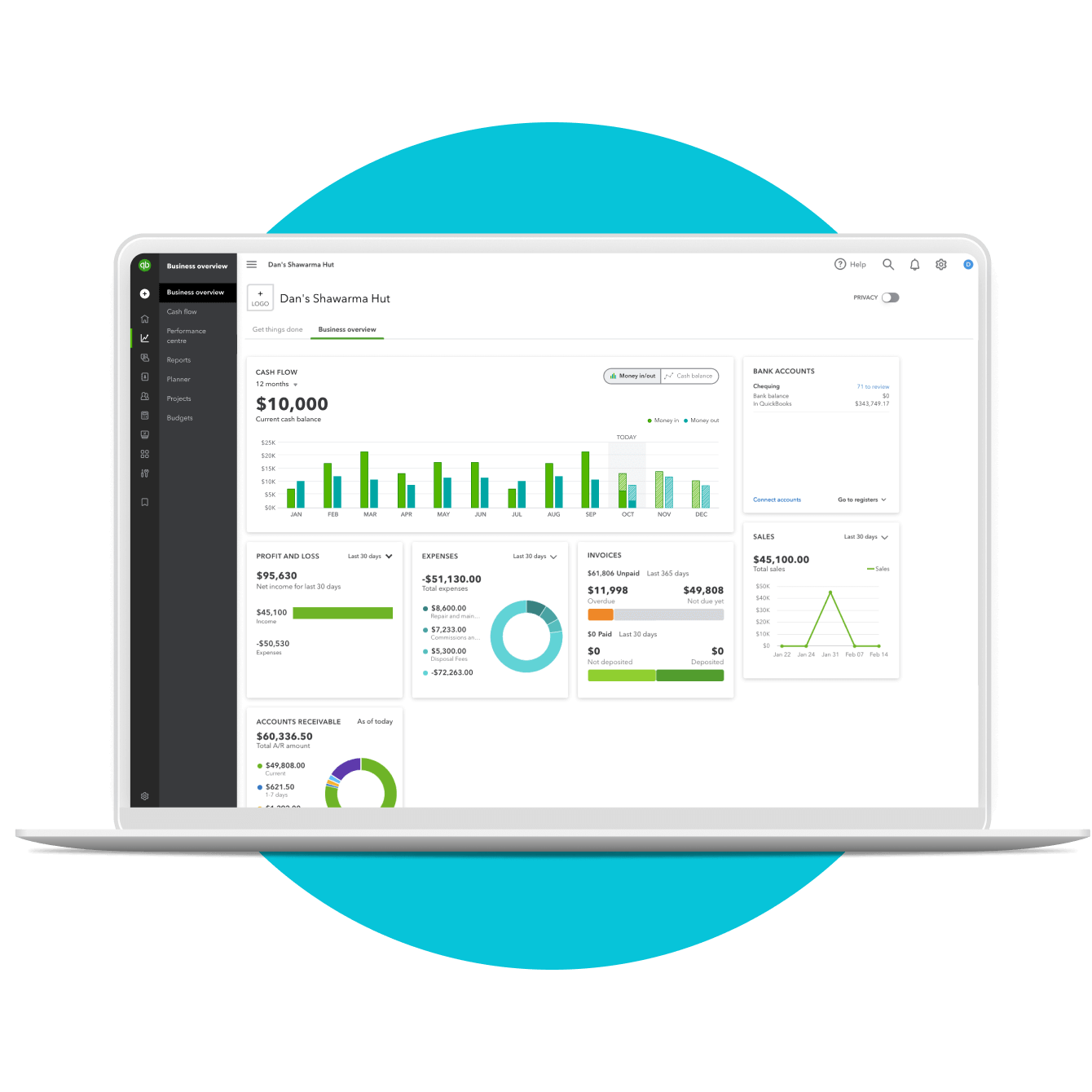

Many of these software supplies easy drop downs to document the transactions, thus making complicated and tedious tasks very easy. The major difference between general journal and particular journal is that the final journal contains all transactions for a enterprise, whereas the special journal consists of only particular types of transactions. The general journal serves as the muse for most businesses’ financial reporting, while the special journal is used for extra detailed reporting. To report a basic journal, you first have to know the account titles and numbers for the accounts that shall be https://www.kelleysbookkeeping.com/ affected by the transaction. Next, you should know the quantity of the transaction in terms of debits and credit.

The entity additionally information other non-financial transactions that occur within the enterprise into this book also. That non-financial transaction included depreciation, changes in addition to an accrual. Those financial transactions including gross sales transactions, purchase transactions, money receipts, money funds, and heaps of different necessary monetary transactions.

It serves as the foundation of the accounting course of, capturing the details of every transaction earlier than they’re posted to the Basic Ledger. The records in the basic ledger may contain information about cash receipts and funds. They can even contain investments made on behalf of the business, debts owed to or by the company, liabilities incurred and passive income obtained.

Understanding journal entries is prime for regulation firms to maintain correct monetary records, ensure compliance, and make informed enterprise choices. A general journal is a e-book of authentic entry in which all transactions are recorded for a enterprise. This contains each debits and credits, and allows for an accurate reflection of the corporate’s monetary position.

- Xero, which also integrates with Clio for streamlined workflows, creates journal entries directly into your basic ledger for transactions like payments on invoices and payments, expense claims, and more.

- Every entry contains the transaction date, accounts affected, quantities debited or credited, and a short description.

- The journal is the place you make the adjustments, while the ledger exhibits the final, corrected outcomes.

- While these have been in apply since record-keeping was accomplished, with advances in technology, almost all firms, and even small businesses are utilizing general journal format software.

- Doc numbers are filled in mechanically in the journal lines and the same quantity will be assigned to all ledger entries after you’ve posted the journal batch.

This is used, for instance, with temporary journal postings that are not important to trace. 💡 F inally, the accounting journal is used to regulate accounting entries. That Is why you want to be certain to maintain it for a minimal of 10 years, from the tip of the financial year concerned.

Please don’t copy, reproduce, modify, distribute or disburse without specific consent from Sage.These articles and related content material is supplied as a common guidance for informational functions solely. These articles and associated content material isn’t an alternative alternative to the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When doubtful, please seek the assistance of your lawyer tax, or compliance professional for counsel.

.png)

.jpeg)

.jpeg)