A fast check of a company’s steadiness sheet, specifically the shareholders’ equity, can present an instantaneous view of solvency. Solvency ratios, such as the solvency ratio and curiosity protection ratio, provide deeper insights into an organization’s capacity to sustain operations. Nonetheless, solvency ought to be evaluated alongside liquidity to get a complete image; a company could stay operational regardless of insolvency if it maintains sufficient liquidity. Buyers must also account for industry-specific solvency standards when analyzing financial statements to make sure correct assessments.

Monetary Leverage

Insolvency is a state of economic misery in which a business or individual is unable to pay their bills. There are a quantity of completely different solvency definition meaning strategies to determine if a enterprise is bancrupt. The other is cash-flow insolvency, the place, over time, an organization cannot continue to pay its debts because of liquidity points.

It reveals how typically the firm’s operating profit can cowl its interest expense. The solvency ratio assesses whether a company generates sufficient cash flow to service its short- and long-term debt. The value of debt is tax-deductible and arguably decrease than the price of equity. Taking on debt to increase the firm’s asset base should improve the return on present fairness.

- Our editors will evaluate what you’ve submitted and determine whether to revise the article.

- The company has total assets value $10 million, which embrace property, machinery, and stock.

- In other words, it tells us how usually a company’s operating revenue can cowl its mounted bills.

- Study from instructors who’ve worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and grasp accounting, monetary analysis, funding banking, financial modeling, and extra.

All The Web Finance Courses You Need

Solvency is determined by analyzing the company’s belongings, liabilities, and equity to make sure that its long-term liabilities do not exceed the worth of its assets. For this cause, the quickest assessment of a company’s solvency is its assets minus liabilities, which equal its shareholders’ equity. There are also solvency ratios, which might highlight sure areas of solvency for deeper analysis.

By including solvency provisions, parties can cut back monetary risks, maintain confidence in their partnerships, and set up clear treatments in case of insolvency. These clauses defend both parties and guarantee the long-term viability of their settlement. Whereas companies should all the time strive to have extra belongings than liabilities, the margin for his or her surplus can change depending on their enterprise. Shareholders’ equity on the balance sheet shortly reveals solvency and financial health. Maintain a gentle eye on each your business’s liquidity and solvency to remain on prime of its monetary picture. If an individual becomes bancrupt and has money owed forgiven, the Inside Revenue Service (IRS) doesn’t think about the debt to be taxable revenue.

A firm may have giant anticipated cash circulate but a really small chance of repaying its bills. Suppose Agency A has a prospective debt fee of $1,000 however no present capability to pay the debt. However, Firm A has a 25% likelihood of receiving $10,000 earlier than the maturity date however a 75% chance of receiving $0.

For example, you would possibly provide your small business with liquidity by discovering ways to enhance its money circulate – corresponding to by providing a discount to receives a commission https://www.personal-accounting.org/ sooner. It can handle danger (such as purchasers not paying), use its sources to grow, and keep the shareholders joyful. A enterprise with poor liquidity will battle to pay its workers and suppliers. This might be as a outcome of their customers pay them late, which slows their money circulate.

Right Here, “fair value” is equal to fair market worth at the time of the transfer. Since the speed of a sale impacts the purchase value of the property, the firm’s liquidated belongings’ truthful market value is determined by the timing of the sale, among different elements. In common, courts eschew the assumption that belongings are liquidated in fire-sale auctions since such auctions are not value-maximizing. Solvency refers to the monetary stability of a party, indicating their capability to satisfy long-term obligations and continue operations without risk of default or chapter. In contractual agreements, solvency is commonly addressed to make certain that a party has the financial capacity to meet their obligations under the contract.

Solvency is a financial metric that measures an organization’s capacity to meet its long-term obligations and debts. It is an essential side of monetary well being, indicating whether or not a enterprise can proceed its operations without dealing with monetary distress. For enterprise house owners, understanding solvency is essential as it affects their capability to secure financing, manage money flow, and make strategic choices.

By watching your solvency and liquidity, you’ll make higher selections for each your daily operations and your long-term monetary planning. A enterprise with liquidity has sufficient money to pay its suppliers and staff. This liquidity also protects it in opposition to monetary difficulties, like durations of low productiveness as a end result of illness, adjustments in market circumstances, and sudden costs. To work out her solvency, she divides 60,000 (50,000 + 10,000) by 300,000, which equals 20%. A ratio of 20% or above is taken into account healthy, so Martha’s business has a good probability of paying its debts through the years.

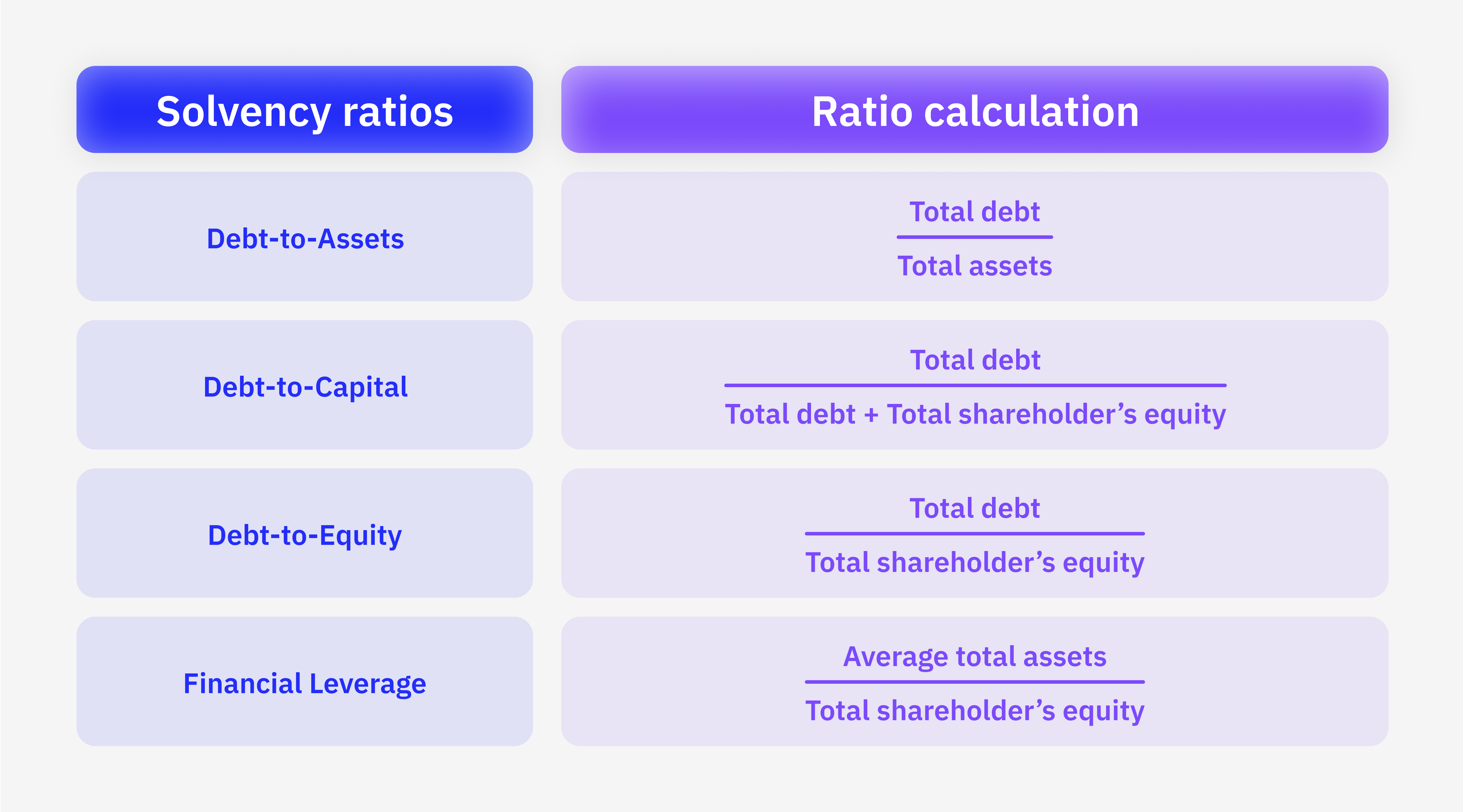

Still, to conduct a comprehensive ratio analysis, one needs to understand and use numerous types of financial ratios in conjunction. The debt-to-assets ratio examines a firm’s whole debt compared to its whole belongings. In different words, it reveals what portion of the company’s debts can be paid off with its property. In this case, debt includes all liabilities, from bank credit to trade payables, deferred taxes, unearned income, wages payable, and so on. These are just some examples of the solvency ratios used to assess an entity’s monetary well being. Completely Different ratios present totally different insights, and their interpretation might range relying on the trade and specific circumstances.